The Crude Life Podcast Episode 34

March 11, 2020

Guests/Topics:

Jon Clark, Clark Energy Consulting gives and update on the Oil Price War and Politics.

Oil futures plummeted over the weekend after Saudi Arabia slashed prices and ramped up production in response to Russian reluctance to scale back output. Makes logical sense, right?

“It starts with the virus,” said Yergin, vice chairman of IHS Markit. “In the first quarter, we estimate that oil demand compared to last year was down almost 4 million barrels a day.” That’s significant. Add to that an output hike from Saudi Arabia, US sanctions on Russia’s Nord Stream 2 gas pipeline to Europe, protecting the “Petrodollar,” and an election year where geopolitics are extremely heightened, and we have an all-out price war.

The WallStreet Journal writes “The situation has gone from gloomy to grim. Oil demand is down. The coronavirus has reduced trade and travel. Riyadh offered discounts of as much as $13 a barrel. The Saudi’s just lifted a finger and said “pricing discount.”

Shale Fights For Survival: This Time it’s Different

In 2016, during the previous downturn (also an election year when we saw a low of $26 per barrel in late February) investors poured billions into cash-strapped U.S. firms through equity offerings and private funds. OPEC+ agreed to curtail output to support prices, which also subsidized higher-cost shale drilling.

“Companies could also continue selling assets to generate cash, but only if there are interested buyers offering reasonable prices – a big if.” – WSJ

“Overhead ‘at those companies is eating them alive. Checkerboard acreage makes them inefficient. No one wants to put up the cash, so the industry seems to be frozen.'” Said John D. Arnold, a billionaire investor.

“The latest move are part of a strategic game after U.S. shale production fundamentally shifted supply, market share and pricing power. Saudi Arabia pushed prices down late in 2014 to curb U.S. production, but it didn’t work: Producers cut costs and lenders and investors stepped in to keep the shale party going. Russia has had enough. It seems to be betting that the price war will permanently impair U.S. production and market share. Now Saudi Arabia wants Moscow to reconsider production cuts, but there is no evidence yet that playing hardball with Russia will work.”

“Bankruptcies will be more substantial and have a bigger impact on supply than they did back then,” said Shawn Reynolds, a portfolio manager at asset firm VanEck. “There’s only a dozen or two [shale] companies that can survive at $40.”

“Probably 50% of the public E&Ps will go bankrupt over the next two years,” said Pioneer Natural Resources CEO Scott Sheffield.

But ultimately, Yergin said, “I don’t think this can last very long because it’s going to hit everybody’s finances including that of the countries,” referring in particular to Saudi Arabia and Russia.

The silver lining is that “$35 oil reduces the economic case for cutting fossil fuels. Green-energy plans might be shelved.

Energy Stocks Dive to a 15-Year Low on Monday:

Apache (-54%)

Oxy (-52%)

Marathon (-49%)

Diamondback (-48%)

Whiting (-40%)

Parsley (-39%)

Pioneer (-39%)

Noble (-30%)

BP (-19%)

Total (-18%)

Shell (-17%)

Chevron (-15%)

Exxon (-12%)

William Prentice, CEO, Meridian Energy Group, gives some examples of environmental innovations the Davis Refinery has implemented into the pre-construction phase along with what technology has been replaced.

Daily Headlines:

Outlook for oil and gas demand remains strong

Major oil and gas producer in the Permian cuts spending by $1 billion

Sponsor: Elite Energy Services

Elite Energy Services’ mission is to be the most honest and ethical trade partner of choice. To deliver high-quality, cost-effective projects on schedule by employing and supporting motivated, flexible, and focused teams. They value the importance of their relationships and will continue to remain fair and true in their dealings with all employees, clients, vendors, and partners. http://www.eliteenergyservices.org/

Featured Event:

83rd Annual Convention & Expo KIOGA Midyear Meeting, Clarion Inn, Garden City, Ks. April 15-17, 2020

Social Media Moment

Could oil really fall to less than $10 per barrel? – CNBC

Via email – Chad P Yes, I get it….we also have plans in case china attacks us. No, they never will, but we have plans…. But oil below $10??

Via NiobraraChalk – James Richardson Not with the current rate of hyper inflation induced by government minimum wage increases. Corona virus may push it down that low but to speculate over a 10 year period what it will do is like asking your crystal ball what will happen in the future.

Via The Crude Life – Jack Hamlin This is absolutely stupid and is not rooted in any sort of fundamental understanding of oil and gas production.

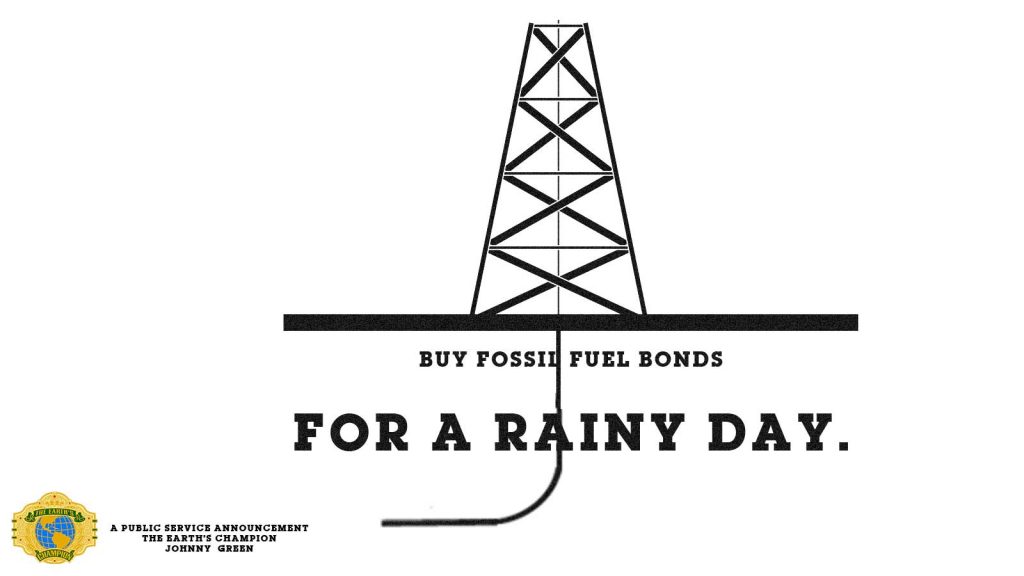

The Earth’s Champion Johnny Green’s Eco-Watch: The Main Challenges Faced By The Upcoming EV Era

The Earth’s Champion Johnny Green (not pictured above) has been traveling across the planet cleaning streets, sidewalks, swamps and souls as part of the Clean Your Mind Tour.

The Eco-Champ is engaging with people from all of Earth’s nations about the eco-realities cell phone usage and environmental energy.

The Greatest Environmentalist on Earth is letting the world know environmentalists have lost their way and Renewables Ain’t Doable Without Fossil Fuelables.

Planet Service Announcement:

Links to Exclusive Interviews:

Jon Clark, Clark Energy Consulting

William Prentice, CEO, Meridian Energy Group

The Crude Life Music Crossover: Blind Joe

Studio Sponsor: Hatch Coaching

Phone Line Sponsor: Bakken BBQ

The Crude Life Podcast can be heard every Monday through Thursday with a Week in Review on Friday.

Spread the word. Support the industry. Share the energy.