Andrew Dittmar, Enverus joined The Crude Life to discuss some of the recent M&A activity in the energy sector.

“So power, hydrogen, carbon capture and sequestration really run the gamut. And then my team within the broader Inveris universe is the research team,” Dittmar said. “We’re comprised of Over 100 analysts, we write research reports that are sent out to industry participants as well as financial institutions and cover a broad array of topics. But my particular focus is on the mergers and acquisitions side and mostly within the upstream or oil and gas production portion of the business.”

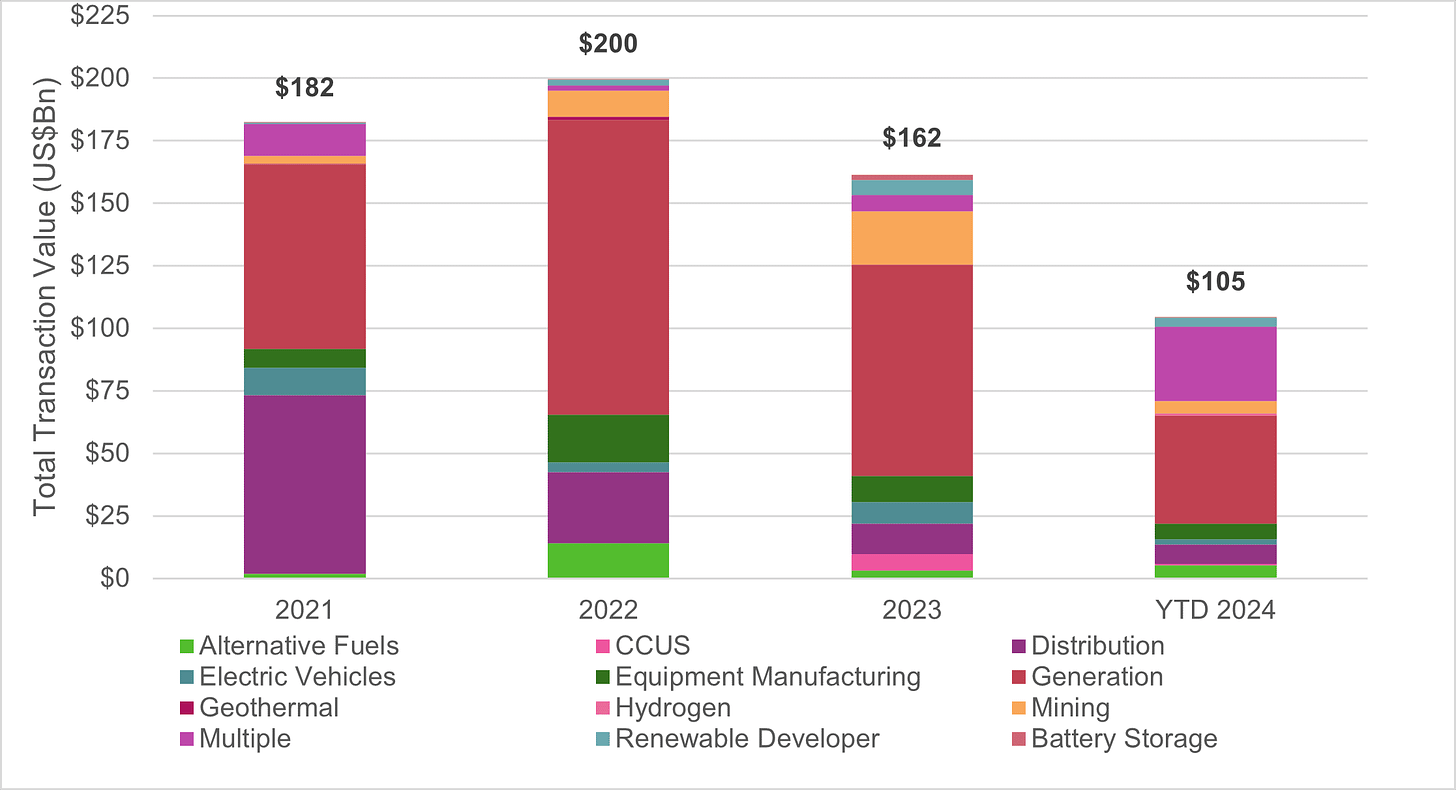

Enverus Intelligence® Research (EIR), a subsidiary of Enverus, an energy-dedicated SaaS company that leverages generative AI across its solutions, is releasing a summary of power and energy transition M&A for the first half of 2024.

EIR has tracked $79 billion in power asset and energy transition M&A through the first half of 2024 across 234 deals with a reported value putting M&A slightly ahead of 2023’s pace of $74 billion in the first six months, although the count for deals with a disclosed value declined by 35%. Including those where no value was disclosed, there were 540 announced deals in 1H24 compared to 877 deals in the first half of 2023.

Recording nearly $80 billion through the first six months of 2024, plus an additional $26 billion so far in 3Q24, is a showing of strength for power and energy transition deal markets despite multiple challenges including macro-economic factors like sustained higher interest rates that have raised financing costs.

“Industry specific challenges have included weakening pricing for renewable fuel credits (LCFS and D4/5/6 RIN prices) as well as lithium carbonate equivalent (LCE) pricing. A volatile environmental credits market has sparked uncertainty in investors’ minds leading to a compression in deal flow in alternative fuels in the U.S.,” said Ian Nieboer, managing director and head of Energy Transition at EIR.

Source: Enverus Intelligence® Research, Enverus Energy Transition M&A

In other power markets, particularly generation and storage assets in North America and Europe, have been a primary driver of energy transition deal value with $32.5 billion transacted through the first half of 2024. Europe led all regions with $17.1 billion in generation deals followed by North America with $7.4 billion transacted. The heightened activity in Europe is driven by the continent’s aggressive carbon reduction goals and efforts to pivot away from Russian natural gas. Within the U.S., ERCOT, MISO and PJM independent system operators have been a primary driver of deal activity in 2024. U.S. total load is forecast to grow 42% by 2050 from today driven by population growth, increased data center demand and electric vehicle adoption.

“Overall growth in the load, combined with greater integration of renewable generation assets, is creating unique opportunities in both generation and storage for nimble buyers,” Nieboer said.

Within generation deals, solar deals led through the first half of 2024 with $8.2 billion in announced deal value closely followed by offshore wind at $8 billion and onshore wind with $5.3 billion in announced deal value. Despite offshore wind leading in recently announced deals, markets have historically been cool to the idea of companies adding more offshore wind exposure with buyers declining on average 1.9% after announcing offshore wind acquisition while acquirers of onshore wind saw an average 1.3% gain. That is likely related to apprehension about high capital costs, long project timelines and regulatory risk for offshore wind.

While renewable penetration into power markets is increasing, some buyers see the value in owning existing gas assets that will provide reliability to the grid. In one of the more notable recent transactions in the power market, private equity firm Quantum Capital Group purchased Cogentrix Energy for $3 billion from Carlyle Group. The deal adds more than 5 gigawatts of natural gas-fired generation primarily in PJM, where gas generation is vital due to grid stability issues caused by coal retirements, intermittent renewables and increasing data center demand.

The largest decline in deals associated with energy transition has been in raw materials, with mining sector deals falling from $11 billion in the first half of 2023 to just $1.7 billion in 1H24. That tracks a precipitous decline in pricing with LCE declining in 2Q24 to sub-$12,000/tonne after hitting a peak of $81,000/tonne in December 2022. Alternative fuel deals were similarly challenged due to the decline in credit pricing in the U.S., which had been a primary focus of transactions in this space. However, a large investment by KKR in European biorefining and biomethane assets kept alternative fuel deal value relatively flat at $2.2 billion in 1H24 compared to $2.7 billion through the first six months of 2023.

“International investment by firms like KKR highlight the global nature of energy transition combined with differing policy priorities and incentives between regions that allow firms to reduce risk by diversifying geographic exposure,” Nieboer said.

Other energy transition technologies like CCUS and hydrogen remain at a less commercial stage of development and investment there is still largely focused on asset development and partnership rather than M&A. According to EIR data, 96% of tracked U.S. clean hydrogen capacity skewed to early development stages. However, deal activity should accelerate as more companies look to speed up exposure to these technologies by buying in to existing projects. Hydrogen M&A has increased sevenfold in deal value so far in 2024 compared to 2023.

“Looking forward toward 2025, we see continued strength for power market deals on the back of U.S. load growth and potential tailwinds from the macro-economic environment as the Federal Reserve pivots to rate cuts,” added Nieboer.

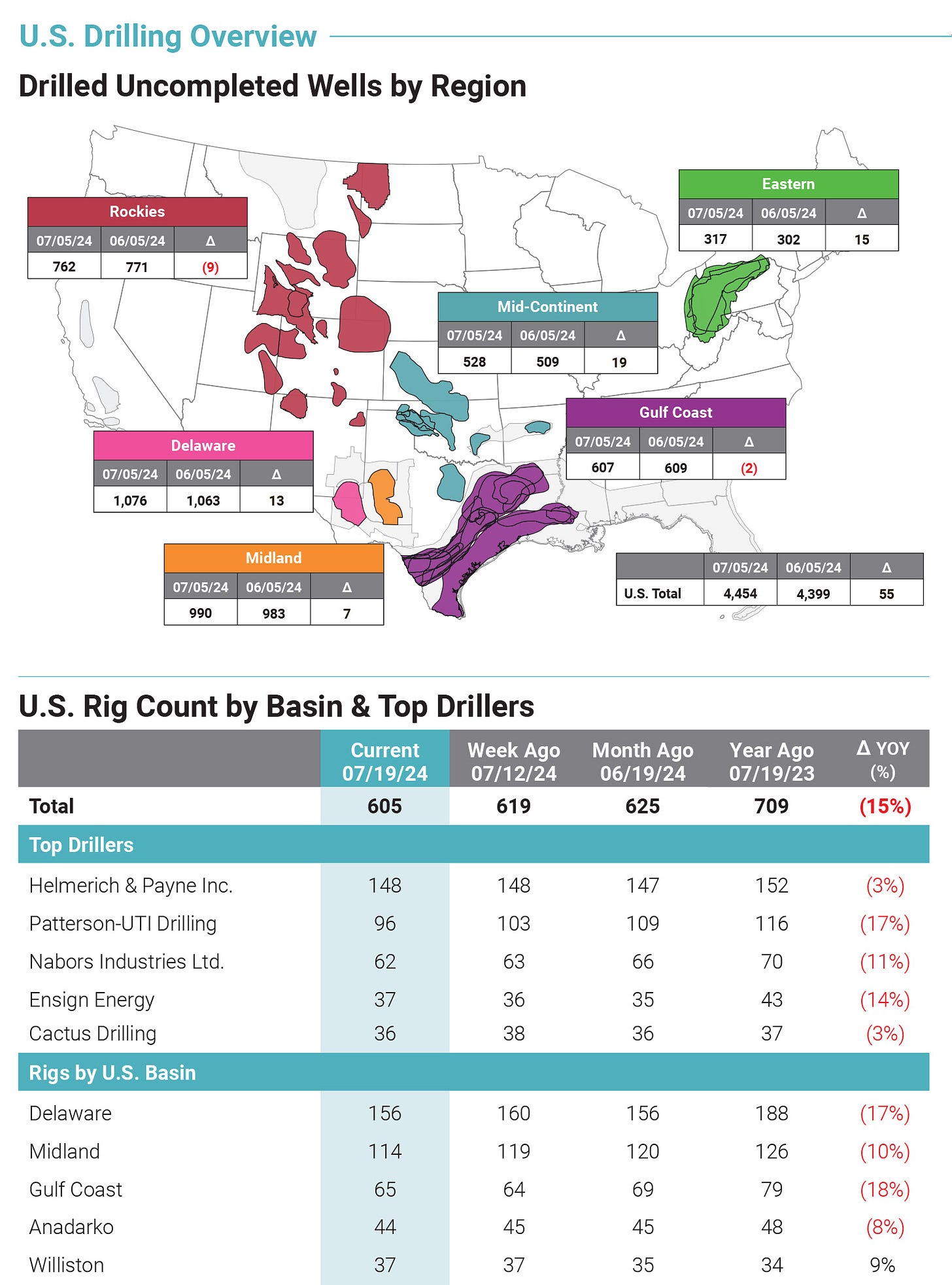

Enverus also released a list of top drillers and customer rankings in the U.S., as well as detailed drilling rig analytics.

Included in the release is a compilation of exclusive tables showing the most active drillers by footage, ranking both the contractors and their customers. Powered by Enverus Core® data, these leaderboards also include average drilling speeds, measured depth (MD), laterals and rig counts, average fluid and proppant loads per foot, and comparison to their rankings the previous quarter. The list was featured in Oilfield Pulse, a bi-monthly report that covers the oilfield services sector, including contracts, the deal market, finance and new technology offerings.

“Enverus empowers us with unparalleled access to vital information, enabling us to maintain a competitive edge,” said Thomas Greene, senior marketing analyst at Tenaris and current customer of Enverus Intelligence® Research. “In our data-driven culture, where critical decisions rely on robust analysis, Enverus is absolutely essential. Without their comprehensive data resources, we would lack the insights necessary to excel in our roles and retain our leadership position in the market.” Neither Tenaris nor their employees were compensated for this statement.

“Enverus’ top drilling and customer rankings reveal who’s leading among some of the most important drilling matrix in the industry,” said Mark Chapman, principal analyst – OFS at Enverus Intelligence Research. “Rankings like these provide a comprehensive overview of market dynamics, identify who’s who and help operators make informed decisions to optimize efficiency and reduce costs. These rankings are a testament to Enverus’ commitment to delivering actionable insights that drive the energy sector forward.”

Enverus is also making its Drilldown Report, which provides a weekly summary of North American rig activity, broken down by target hydrocarbon, well orientation, operator, contractor, region and play, available to the media. Other activity metrics presented in this report are permits, detected pads, frac crews and DUCs, with regional breakdowns. Regional leaderboards track the top 10 operators by rig count and permits.