Kunal Patel is a senior business economist at the Federal Reserve Bank of Dallas joins The Crude Life’s founder Jason Spiess for an update on the oil and gas activity in the 11th District, including the Permian Basin, Eagleford and Haynesville basins in Texas.

Growth in the oil and gas sector stalled out in first quarter 2023, according to oil and gas executives responding to the Dallas Fed Energy Survey. The business activity index—the survey’s broadest measure of conditions facing Eleventh District energy firms—was 2.1 in the first quarter, down sharply from 30.3 in fourth quarter 2022. The near-zero reading indicates activity was largely unchanged from the prior quarter, a break from the more than two-year stretch of rising activity.

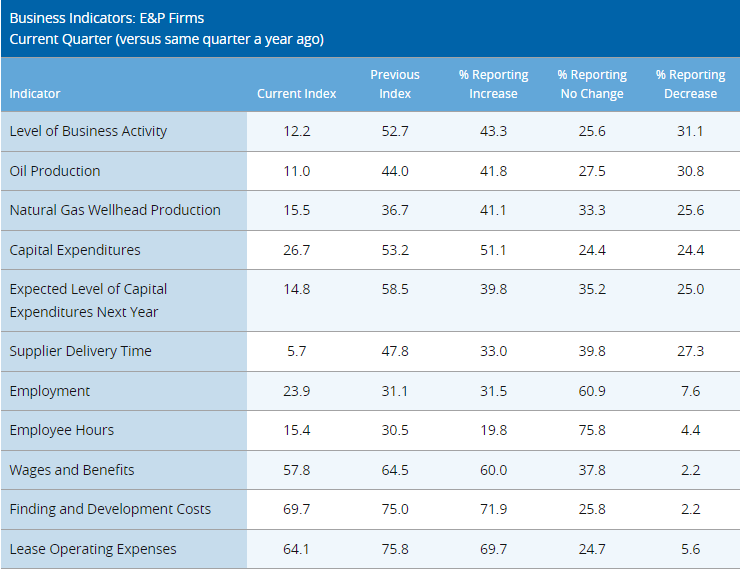

Oil and natural gas production increased at a slower pace compared with the prior quarter, according to executives at exploration and production (E&P) firms. The oil production index remained positive but declined to 10.5 in the first quarter from 25.8 in the fourth. Similarly, the natural gas production index fell to 7.4 from 29.4.

Firms reported rising costs for a ninth consecutive quarter as all series remained significantly above their averages. Among oilfield services firms, the input cost index was roughly unchanged at an elevated 61.6. Among E&P firms, the finding and development costs index slipped to 46.8 from 52.5. Additionally, the lease operating expenses index declined 11 points to 37.6.

The supplier delivery time index for all firms moved into negative territory, declining to -14.0 in the first quarter from 14.4 in the fourth. This is the first negative reading since fourth quarter 2020 and signals that it takes less time to receive materials and equipment relative to the prior quarter. Among oilfield services firms, the measure of lag time in delivery of services declined to zero from 20.0, suggesting delivery times for these firms are no longer increasing.

For oilfield services firms, the equipment utilization index slid 29 points to 3.9 in the first quarter. The operating margin index declined to 1.9 from 25.9. The index of prices received for services remained positive but declined to 25.0 from 43.6.

Indexes related to employment and hours worked eased in the first quarter. The aggregate employment index posted a ninth consecutive positive reading but dipped to 14.3 from 25.7. The aggregate employee hours index declined to 12.3 from 27.7 in the prior quarter. Meanwhile, the aggregate wages and benefits index edged higher, to 43.6 from 40.2.

The company outlook index turned negative in the first quarter, falling 27 points to -14.1. The overall outlook uncertainty index increased 23 points to 62.6, pointing to firms’ continued heightened uncertainty regarding their outlooks. Sixty-eight percent of firms reported greater uncertainty.

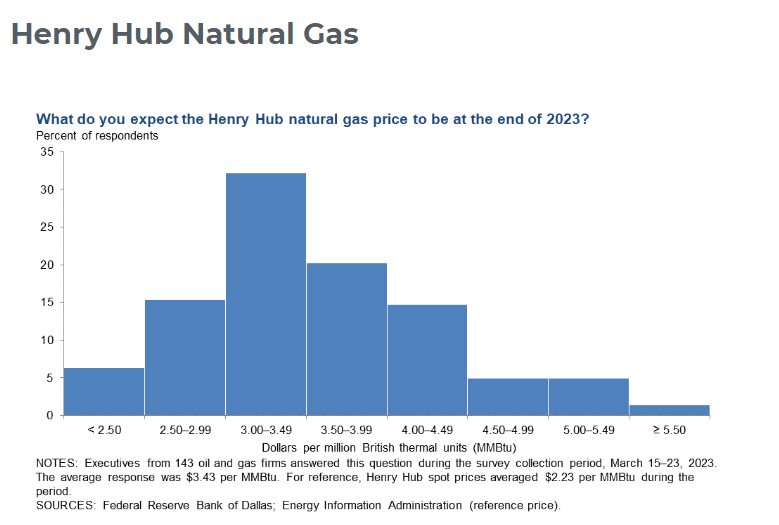

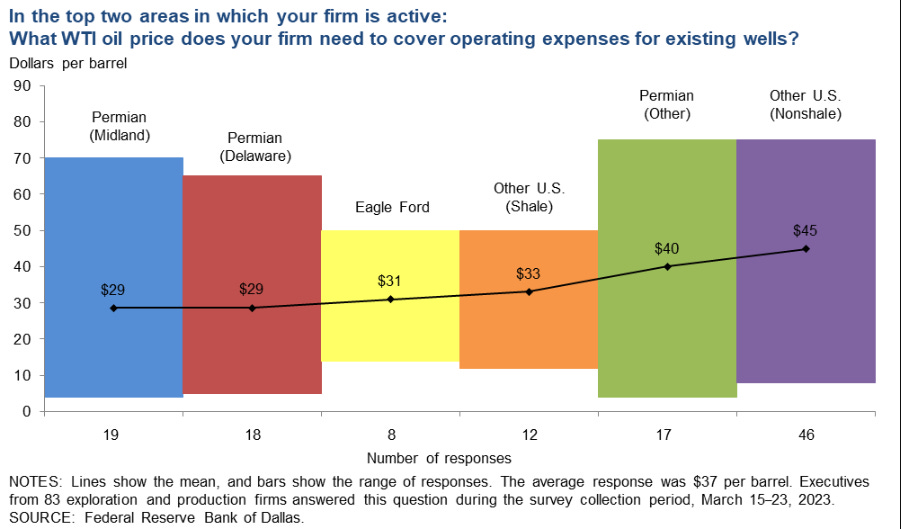

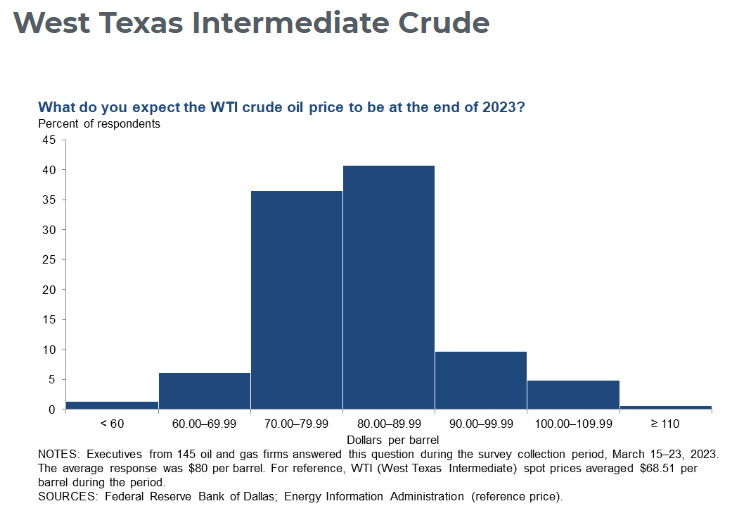

On average, respondents expect a West Texas Intermediate (WTI) oil price of $80 per barrel by year-end 2023; responses ranged from $50 to $160 per barrel. Survey participants expect Henry Hub natural gas prices of $3.43 per million British thermal units (MMBtu) at year-end. For reference, WTI spot prices averaged $68.51 per barrel during the survey collection period, and Henry Hub spot prices averaged $2.23 per MMBtu.

Next Dallas Federal Reserve Study will be released June 22, 2023

Other topics included in the interview:

– Companies are finding the factors behind cost increase and potential ways to reduce them.

– Explore new methods to attract younger workers to the industry, such as apprenticeships or training programs.

– Monitor the impact of new regulations on the industry’s performance and plan responses accordingly.

– Explore options for providing more work-life balance or flexible schedules for employees.

– Consider offering competitive compensation packages to attract and retain skilled workers.

– Investigate ways to improve the efficiency of processes to decrease the need for labor.

– Monitor cost inflation and global economic conditions closely and adjust strategies accordingly.

– ESG-related questions not included in survey, however the acronym has popped up in the past surveys and is often one of the concerns of oil and gas companies.

About the Survey: Data were collected March 15–23, and 147 energy firms responded. Of the respondents, 95 were exploration and production firms and 52 were oilfield services firms.

The Dallas Fed conducts the Dallas Fed Energy Survey quarterly to obtain a timely assessment of energy activity among oil and gas firms located or headquartered in the Eleventh District.

Firms are asked whether business activity, employment, capital expenditures and other indicators increased, decreased or remained unchanged compared with the prior quarter and with the same quarter a year ago. Survey responses are used to calculate an index for each indicator.

Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the previous quarter.

If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the previous quarter.

Jason Spiess

Let’s go to the Zoom Line where we’ve got Kaal Patel with us with the Dallas Federal Reserve. I forget which chapter. Which district it is. It is the 11th district. Seventh district. Which district? Canal?

Kunal Patel

Uh, we, we’re with the, the 11th

Jason Spiess

district. All right. Thank you very much for joining us. How are you doing today? By the way,

Kunal Patel

I’m doing great, Jason, how are you doing today?

Jason Spiess

You know, not too bad. I’m up here in the Dakotas and we’re starting to get our, uh, spring thaw coming in. We just got socked with two ft of snow like last week and then two days later it’s 50 degrees. So we might have another flood season on our hands. Who knows? Um, you’re down in Dallas. What, uh, what is 75 degrees today? Everything’s fine. People in shorts. What

Kunal Patel

Good guess on the 75. I think that, uh, we had a little bit of cold weather earlier a couple of days ago. So

Jason Spiess

You guys got hit too with a little bit of 40° weather. …

Kunal Patel

The funny thing is, I don’t even know if it got to 40. It might have been a little bit close to the 50s. It was definitely a surprise for April,

Jason Spiess

you know, not to editorialize here because that’s not why you’re brought in. But isn’t it funny on social media to see the different geographies and how they react to weather?

Kunal Patel

Oh, without a doubt. I, I think I had a friend growing up that would wear like shorts when it was like, 30° outside in Dallas and he’s from Canada. So it was kind of like, you know, it’s much more colder in Canada than it is here. It’s OK to wear shorts outside. Even when it’s 30°.

Jason Spiess

I can just remember like 10 years ago when social media first started becoming more national, if you will. And, uh, Dallas, when Dallas would get an inch of snow, you guys would shut the freeways down and everything. Of course, up in North Dakota, we laugh, we’re like an inch of snow. Great. Yeah. Ok. Walk to school today. And so it’s a, it’s a whole different, you know, uh, a geographical ball game when we look at these different things.

But that’s the way it is. You know, my son, you mentioned the shorts. You know, my son, he’s a teenager. He just turned 17 last week and he still wears shorts every day. It would be, I mean, we actually had to have a family meeting in case the car stalled and he’s in shorts that at least he’s got to bring with a pair of sweatpants because I get it that, you know, you get in the car, it’s warm, you walk outside for two seconds, you’re inside the building.

But, you know, if we get stuck in a snow bank and you’re in shorts and it’s minus 30 degree weather, we’re gonna go to jail. We don’t care about your legs. We’re more concerned about going to jail, son. So we had to have those conversations with them. Always,

Kunal Patel

always a good idea. I, I, during the winter time, I generally keep the jacket the summertime. You know, don’t, don’t need anything. Hopefully, it doesn’t get too hot in, in, in Texas, but always good to keep at least one jacket in the car. You never know when you need

Jason Spiess

it. Speaking of hot in Texas, uh, most of the oil and gas activity seems to be coming out of Texas, at least the, uh, oil activity. I know Pennsylvania is very big in the gas activity. But, uh, when we’re taking a look at the Permian basin and the Eagle Ford, the Haynesville, I’m not sure if the wolf camp came up in the survey or not. But, uh, let’s go ahead and take a look at the recent survey that came out.

March 29th is available at the Dallas, uh, fed dot org if you’d like to go ahead and take a look at this survey. But, uh, what’s kind of the, the quick takeaway for those if you’re an oil exec or you’re an investor. Uh What’s, what’s the takeaway for those people?

Kunal Patel

So the, the main takeaway and let me take a step back just in case like, uh I think there’s quite a few that are familiar with the survey, but it is, you know, in this latest survey we did survey 100 and 47 upstream oil and gas firms, the data was collected from March 15th to the 23rd. Um 95 were exploration of production firms. 52 were oil and gas support services firms generally known as services firms.

And we, we have these indexes that kind of give you an idea whether there’s an expansion or a contraction over the prior quarter. It gives an idea of direction and, and the main takeaways is that many of you noticed that there’s been an expansion over the past like two plus years. And the latest activity index is suggesting that the expansion since she is, I mean, it was kind of like stall out.

Uh the index came in close to zero. So it’s kind of indicating the activity was just largely unchanged from the prior quarter. Uh The other key takeaways, many of, you know, this, you know, cost they could just continue to increase. Um We did see a little bit of easing in the supply chain for this, this current quarter. Um employment growth that continues, but it does suggest maybe it’s a, a little bit slower than in prior quarters.

But that wage inflation continues to remain if I was to leave off 11 another big, big takeaway, just the executives have started to, you know, their outlook. It, it turned negative again. This is a quarter of a quarter. So compared to where they were last quarter, they’re a little bit more pessimistic. Um And then when it comes to uncertainty, they significantly more uncertain.

I think what we saw in this latest quarter was, of course, you know, a softening in commodity prices, both oil and natural gas. And then of course, in our comment section, uh if the executives allow us to publish their comments, um they’re anonymous, but they, they can give you an idea of the, the um reasons for them to be uncertain whether it’s cost inflation, whether it’s continuing to be labor and material shortages, uh or it just could be price volatility.

Um And of course, uh there’s a lot on the regulatory environment. So a, a lot of takeaways. Uh I try to shorten it down as much as I could, but I think that’s, those are the main takeaways from our latest survey.

Jason Spiess

You know, one of the memories that was going through my head when you were talking was, you know, we started the conversation with Dallas and I’ve been to Dallas a few times and, and I’ve been to a few um skyscrapers down there. A lot of oil and gas companies have skyscrapers in Dallas. And um that’s where the corporate offices are. Houston, Dallas, et cetera, Denver, I guess would be another place.

But, uh, in Dallas, I, I specifically remember one company and I, and I’m not gonna mention their name because that I don’t want to take away from the story, but there was four, they got at least be making six figures if you’re, you know, you’re, if you, if you’re ac suite executive. So I, I figure there’s close to a million dollars worth of salaries in this room.

And I’m trying to explain to them that, you know, the oil and gas industry really is going down the path of cigarettes and coal and just being targeted in a very public anti, you know, pr way. And I basically got escorted out of the office with security. I mean, boy, they didn’t want to hear that nothing to do with it. And now that, you know, a week later the Wall Street Journal had a headline that said oil and gas is the new cigarettes or something like that. And I thought, yeah, someone

else says that they, they hear it. I’m hearing more and more people really start to. This sentiment is picking up more and more that they’re right. Really getting concerned now that this might become a reality where the image of oil and gas is not as popular as they once thought. Uh, did that come up in your survey at all? Uh the the industry image impacting any part of the industry because I’m hearing it up here in the Bakken. …

Kunal Patel

So, so we, we, we did not ask like a specific like question around this. Um uh Obviously the topic has come up from time to time and we, we do have these anonymous executive comments and, and they do kind of reference, uh you know, the sentiment that the industry has from, let’s say whether it’s the public or the government or from, even from uh financial providers.

Um some of it could be just, uh there’s just, it, it could, it could be something related to as, you know, E S G, but sometimes it could just be just a, a view about fossil fuels in general, but we actually did not ask any like specific questions. So it kind of falls outside like the, the study in many times is purely about, you know, the, what’s the activity um in oil and oil and gas, you know, what’s the employment, what’s happening to costs?

Um uh But the sentiment can make a difference, right? Um uh Sentiment can impact as, you know, uh financing, it can impact valuations. Um uh but, but, you know, the, you know, the, the comments do kind of touch on some of this maybe, but they don’t, they don’t, I guess call it out as much as it, they kind of mentioned it,

Jason Spiess

you know, the, um the E S G s part of it and, and some of those investment parts, um, that I definitely can see, but even part of some of the workforce actually is where I was more or less coming from with the question because it seems a lot of the younger generation just isn’t really coming into the industry.

And in, in North Dakota anyways, they’re already talking about looking overseas to like the Ukraine or Poland or some other places to bring in some workers. And so, uh how about from like the workforce side of things I did, did that sentiment come up in, in there at all?

Kunal Patel

So the most one that we could kind of correlate to one of the questions we asked, we did ask, it’s a one off question. It was which of the following is the primary factor causing worker shortages in the oil field. And we asked this question because pretty much for the last two years, every energy surveyed in the comment section, there’s at least two or three comments around uh challenges, you know, securing labor, um turnover, wage, inflation and so on and so forth.

So we get 128 responses. Again, they were asked to pick the primary factor. Um the first most picked act uh choice was cyclical nature of the industry. You know, that kind of covers the, the the price volatility that we’ve seen over the past, let’s say 15 years. Um but the second most picked one which was picked by 27% was a perception of limited career potential due to the energy transition.

But kind of debate, what would be the right choice to kind of capture this? Could it just be like you mentioned, is it just The the sentiment about the industry itself? We thought though, since it was a job-related question, we’d ask about limited career potential. Again, 27% are other choices. Um you know, lack of work life balance and flexible work schedule that got less than 10%.

But you hear a lot about it where people would like to work from home for some days of the week or like to have a flexible work schedule. That’s really not the, the jobs in the oil which are 60 plus hours. Um We have compensation in other industries, maybe the compensation in the others are, are getting better, less than 10% less attractive work locations as you know, you were mentioning Dallas and Houston and Denver, but many of these oil fill jobs are not in these cities, especially

if you’re working for oil services. Um And so I think everyone would agree that, you know, you know, people like to live in, some people like to live in bigger cities, maybe it’s less, less attractive again, less than 10%. Um and then inability to pass drug test and, or background check that was actually the lowest. Um But, you know, when we look through the comments.

Uh you know, I think there was one that kind of caught me. It was like currently finding skilled labor is our biggest challenge. Rates of pay have risen to the point that they’re diminishing our gross margins and competitors are over paying sometimes paying to the point of offering raises based on the ability to steal the work from our customers.

Um in some cases, it is close to a 30% bump in wages. So there is a lot of wage inflation. Um Some, another person wrote many left the in 2020 are not coming back either due to the age to their age or the booms and busts. Um And, and, and so there is, and, and I guess they also had perceived energy transition concerns seemed less impactful than the overall perception of for work. So each person kind of has kind of debated, You know, what, what is really, really driving it.

Um but like you mentioned, I think the most big answer was the cyclical nature of the industry at the other day. Like I think people looking for a career, right? And if you had the the oil price fell in 2009, 2020. Um And even today, there’s a lot of volatility in the price of oil. I think that can also impact whether you see it as a long term

Jason Spiess

career. It’s interesting too because when I take a look at like the last 10, 12 years when, you know, I, I’m a media guy that happens to be covering oil and gas at the end of the day. So, you know, I, I had to learn kind of that, that cyclical nature and how companies react and how companies kind of go. But in the world of uh artificial intelligence and in the world of uh uncertainty, whether it’s uh image or subsidies or Joe Biden or, you know, whoever they’re going to blame this week in

politics, whatever it might be, the bottom line is that this, this go round of the cyclical nature is different now, whether it’s a supply chain issue, they’ve handled those in the past, but that’s part of it. And I don’t remember the wages ever being an issue over the past 10 to 12 years. That one seems to be coming up at least up in the back. And, um, and in the rocky mountain region, even in the Marcellus, I’m hearing that the wages aren’t as high as what a lot of the entry level people

thought. And then the other kind of, uh, uh bizarre that I, I, I’m curious about is the skilled labor too because as we’re getting into the world of automation and we’re getting into the world of U A s and we’re getting to the world of E S G and scope and acronyms that we’ve never heard of before, whether it starts with a G or an H or a Q or A, or an elemental P, there’s all kinds of acronyms that the stock was another one I saw the other day Stock Act.

So it just, I think they start with the words and then they work their way backwards from there. I’m starting to realize that. But, uh, the question is this, uh, wages are the entry level wages, uh, the same, I guess that they’ve been, or did that come up in your survey? And then the skilled labor part too, is that changing at all? Do you see from this latest survey? …

Kunal Patel

So, uh, I think, I think it would be kind of hard for me to say like, you know, the, they do definitely mention the increasing wages and it continues to be a concern because the wages continue to increase at a very, very strong pace. I’m trying to think of in our last survey. I think someone actually referenced the amount, but it was either, let’s say about 10% or higher, which is pretty, pretty strong, pretty strong wage wage inflation.

And so there continues to be the strong wage inflation when it comes to jobs. As you know, there’s always been commentary that many of these jobs would go away would be placed by something automated. But I think the reality is that, um, you, you, you look at the jobs and today jobs are in total jobs. Our, our levels not seen since 2007 in Texas.

But additionally, what I should add though is the rig count is significantly lower. Um and so when it comes to these old field services jobs in some ways that employment is kind of mirroring that rig count. Um and then when it comes to the EMP jobs, there just isn’t as much of a need for as much planning um and monitoring of uh of wells because you can use technology to remote monitor them.

Um And then when it comes to planning, we, we, you know, shell development has been here since let’s say 2008 with each year, you know, you become more and more sure of, you know, what you’re gonna get from that specific well. And so these companies have been able to do with less employees what they used to do. So I think that’s kind of like the really skilled aspect um uh from, from the corporate perspective is also obviously skilled labor in the, in the oil field itself.

Um But I think that like a lot of it is just efficiency. These, these, these rigs are able to drill these wells significantly faster, they’re able to complete them significantly faster. You’ve heard of Si si, which is allowing them to, I believe my understanding, complete multiple wells at once. Pad drilling definitely helped on the drilling end.

That’s where you’ve seen that impact in terms of labor. Um I think to go back to your question on, on wages in other industries, it’s kind of hard sometimes to, to compare them. Um, because in the old food you’re gonna work 60 hours a week. There may also be overtime tie, I believe there is overtime tied with those additional hours. Uh, maybe in construction it’s, it’s, it’s less hours.

Um, and so there’s a lot of different things you have to consider, um, in terms of wages, in terms of overtime, in terms of a lifestyle. But what I think most people would agree with is that um I think coming out of the pandemic, I mean, sorry, coming out of the, the 2008 downturn, uh you know, oil bounced back pretty strongly. Um and so there was a lot of demand for these four workers um coming in today, there’s still, there’s a lot of demand for many other industries like construction.

Um and, and so it’s kind of hard to say that’s why we asked the question, you know, is it the wages that might be driving them away? They definitely did not put it as their primary, but it could be a secondary or, or third type of uh of of challenge …

Jason Spiess

inflation, supply chain issues. How about with those? Uh have we seen the prices stop? Are they still going up? Are they going backwards? And um what are people talking about with that?

Kunal Patel

So for so when it comes to cost inflation, they continue to see that cost inflation So we have these indexes that kind of compare this quarter versus the the last and within services, that index remains elevated And unchanged, suggesting that those input costs going into services continue to remain, continue to, to increase um at a, at a similar pace with an EMP you know, elevated but slightly slowing in terms of uh uh uh uh of those increases.

So cost inflation continuing, you may see it slow compared to the really strong pace we saw in 2022. I think most would say that it will slow. Um but it may still be above what most would obviously want. I think from the various earnings calls that are out there from publicly listed E MP firms, you know, at 10% is kind of what’s kind of thrown out there for inflation this year and then when it comes to the supply delivery time index that was negative.

So an easing of supply chain issues, essentially the time to receive Uh your delivery from suppliers was was less this quarter versus last. But that that’s the supplier delivery time. The index suggests it’s been increasing since the fourth quarter of 2020. It is kind of debatable. Why did it decrease? Could it just be that it takes time?

Do you know when you put in an order to receive the equipment? It could be that and it may be that the equipment, a lot of it came in the first quarter, it could be also that since activity didn’t continue to increase, uh maybe that provided some relief for this supplier inputs to arrive faster than previously. …

Jason Spiess

What do you think the biggest concern is for the oil and gas operator right now? Down in, down in the permian, down in the Texas area? Is it, is it um uncertainty or, or is there anything specifically? I guess that jumps out as a concern?

Kunal Patel

So we did ask this question um which was which of the following do you believe will have the most influence on the profitability of your firm this year? The the the top two choices that they pick, again, they were only allowed to pick their top one. But cost inflation got 30% of responses and health of the global economy got 30%. So cost inflation very straightforward, they’ve been dealing with very strong cost increases.

Um I think there has been uncertainty of course, on what will costs look like this year. I think last year the the the expect expected cost, inflation was much smaller than what actually occurred. Um And so cost inflation very near very close to their, their operations, something that they are likely uncertain about. Um The other one is the health of the global economy. Uh Again, that can also impact commodity prices. Um I think there are quite a few comments around just concern

about what may happen to the global economy. Did this survey was right after the, the recent banking Uh um and not the right, it’s not sure what the right word to use, but essentially the the the developments in the banking sector, I think that started on March 10. Um and so that can also impact uh you know, that could increase your uncertainty, right? Because you just, you become a little bit uncertain about what, what may happen next. …

Jason Spiess

Do you guys um get into E S G at all? Um That um doesn’t seem like it’d be in your wheelhouse yet. It will be once it’s a little more established. But uh is that in the survey at all? Do you guys get into that much? …

Kunal Patel

It’s a great question. I mean, primarily, you know, it, it may come up in the commentary um as you know, E S G though has been here for quite some time. And so I think when E S G like the started, there was a lot more comments. Um but recently they just haven’t called it just E S G, they may just say something related to sentiment or to financing, but calling out E S G specifically, uh doesn’t happen as much we have.

I don’t believe we’ve ever asked a specific question on E S G. I think he kind of mentioned, you know, it’s like it’s still taking some time to kind of define and so writing the right question is kind of hard.

Jason Spiess

Well, you’re, you’re, you’re kind of in a role where you can’t do anything with it yet. Like you can’t go on official record with it. You, you can’t really, because the fed, you guys have to kind of, you got, you got procedures and rules and protocols, you got to go through before you can just start. You can’t be like, you know, Kevin o’leary Chuck and Molotov cocktails on Fox News.

You can’t do that. Uh We all want to do that kind of stuff but you know, that’s the type of the in the media we’re trained on, on certain, you know, ok, he’s a professor. He can’t really do this, he can’t do that to be respectful to us to, to don’t back him in a corner, you know, on live, on live radio or live television type of a thing.

So that’s why I phrase it the way I did that. I’m not even sure if you guys can even comment on that E S G. What do you guys have an official statement when some like let’s say I’m cold calling you from the media and I want to know about E S G. Do you guys even do anything with that yet? …

Kunal Patel

I, I think that um uh when it comes to E S G, you know, it really, it depends on what the specific question honestly is. Um And uh what happens is that like, we just haven’t asked a specific question around it. I’m not exactly sure what question we would ask to our survey participants. Um But they will comment from time to time about the impact of E S G on their business.

Um I, I think that like, I, I’ve read that they are working to create, like it’s called E S G scores. Uh Companies are working to kind of integrate E S G into their um various practices, but there’s nothing too specific and it just again, depends. I think a lot of times on the question and

Jason Spiess

folks, if you, if you go to the crude life dot com, um we’ve got past interviews with Kaal Patel and E S G has come up in the past, but I, I noticed it didn’t come up in this survey very much. And what made me kind of go go off on this little tangent, I guess was the last question, which of the following do you believe will have the most influence on your profitability of your firm this year?

Uh The first one, as you mentioned, cost inflation 30% 2nd half of the global economy and then the, the fourth was access to and cost of capital last year. That would have said something to do with E S G without a doubt. There’s no question about it. So I see where that’s kind of, it’s changed and evolved and people have either gone away from it or it’s gotten out of their vernacular, but also supply chain issues.

I’d put in cost inflation too. Boy, that’s, those are definitely related. Um ok, so getting back to the survey here, um what do you want people to kind of walk away from this knowing as, as far as if they’re preparing their business? Because there’s so much uncertainty out there. What is certain, …

Kunal Patel

I, I think that, um, so there’s a lot of uncertain certainty out in, in the oil field. Uh I, I think a lot of times though they find certainty in, um, they know what the price of oil is. Um, there’s the, they, they, they, they, they know that, um, there’s a lot of challenges ahead. I, it, it’s, I think that like the, the main thing when they read through this is they kind of can understand what executives are thinking, um, in regards to whether it’s the uncertainty or the outlook.

Um, it’s kind of hard to say though, like, in terms of like takeaways, like what, what, what, um, an executive should think. I think that, I think many people though within, uh, the oil gas space have felt uncertain. I mean, I don’t, I don’t think that’s anything that’s different. Um, I think it’s, it’s the, the future of fossil fuels has always been a topic of, of uncertainty, you know, we’ll be, be using fossil fuels in 10 years, 20 years, 50 years.

Um, but I think that, like, what we have to see is, you know, how, how does this evolve. I think what we, we do know right now is that there is there is quite a lot of cost inflation, at least, maybe we got some relief on the supply chain and uh the the outlook has turned a little bit negative, but you know, sometimes it may be related to the the price of oil and the price of natural gas. And of course, uncertainty is really high.

And so I think we just kind of have to see throughout this year. Do do some of these questions around our uncertainty kind of get answered or did they not? I think the topic that always comes up is the under investments in the oil and gas industry. Um And, uh, but we have to see what impact that has. I think that that under investments may be related just to uncertainty at the end of the day. …

Jason Spiess

Well, one thing that’s certain is that North Dakota is definitely probably gonna flood this year. We just got an email from Governor Berg who’s declaring a statewide emergency for spring flooding, direct state resources to be on standby. Hi. So you might be hearing about us in the news this week. Canal Patel from the Dallas Federal Reserve. We started the interview talking about the potential of a spring flood up here and we’re ending the interview with an email from the

governor declaring a statewide emergency for spring flooding. Well, it looks like we’re gonna be doing some sand bagging of a different kind uh, this year up here. So. Well, sir. Uh I appreciate the time today. And when’s the next survey coming out? And, uh, what kind of information should people know about this one where they can find it and all that good stuff? We’ll have the links at the crude life. But, uh what type of information do you want people to know?

Kunal Patel

Definitely. And of course, uh, stay safe, Jason, it’s always good talking with you. I think that we’ve, we’ve talked many times in the past our, our second quarter release scheduled for Thursday, June 22nd 9 30 AM. Uh, as always, we’ll have some new special questions we’ll ask and then of course we’ll have our regular indexes, but definitely do check it out. It’s on the Dallas fed dot org website and you just go out to surveys and choose the energy survey or you can find it in many,

many other places just straight through Google. Um, but June 22nd 9 30 AM. Uh, it’s a Thursday. Um, uh, and, uh, definitely look out for it. We always appreciate, uh, the, the wide readership that we get, whether it’s people in the industry, people in government, people in academia or, and of course, reporters. Yeah.