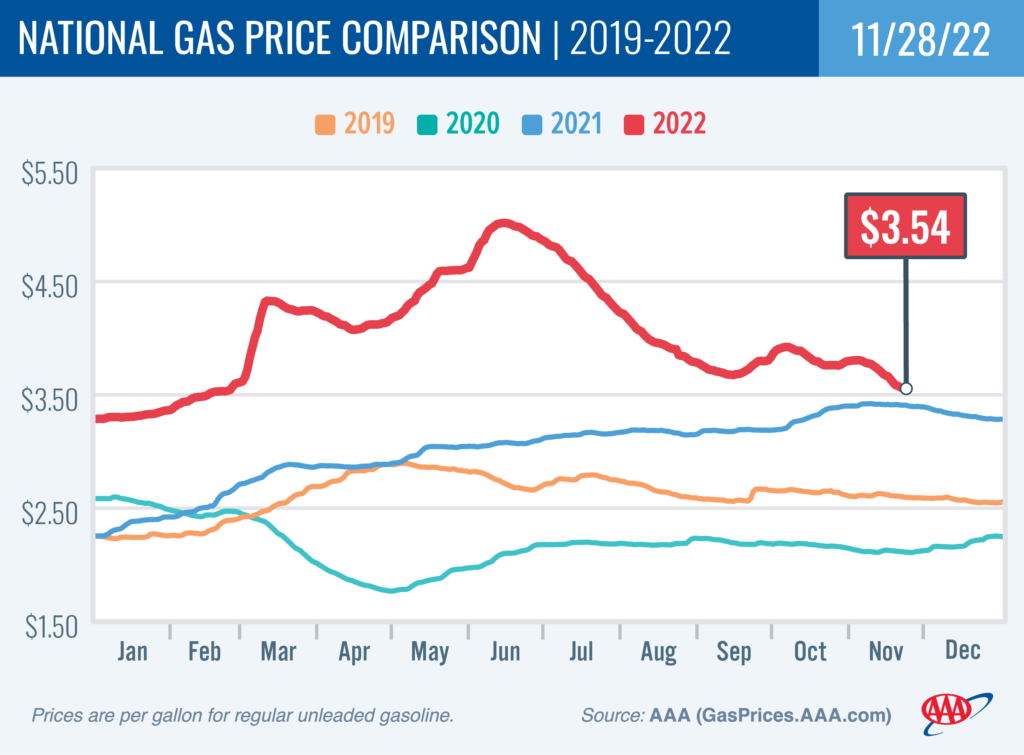

According to AAA, the national average pump price for a gallon of gas dropped 12 cents in the past week. It is the steepest weekly decline since early August—nearly four months ago.

Meanwhile, the cost of oil edged lower on fears of economic slowdowns elsewhere around the globe. Because of these factors, the national average for a gallon of gas fell to $3.54.

“Gas prices are dropping nationwide, with some of the largest decreases happening on the West Coast,” said Andrew Gross, AAA spokesperson. “But the West also has the farthest to fall because its prices are so elevated. For instance, California is still $1.50 higher than the national average.”

According to data from the Energy Information Administration (EIA), gas demand fell from 8.74 million to 8.33 million b/d last week. Meanwhile, total domestic gasoline stocks rose by more than 3 million bbl to 211 million bbl. Increasing supply and fewer drivers fueling up have pushed pump prices lower. As demand remains low and stocks grow, drivers will likely see pump prices keep falling.

Today’s national average of $3.54 is 22 cents less than a month ago and 15 cents more than a year ago.

Quick Stats

- The nation’s top 10 largest weekly decreases: Alaska (−30 cents), California (−21 cents), Indiana (−20 cents), Wisconsin (−20 cents), North Dakota (−20 cents), Nevada (−17 cents), Oregon (−17 cents), Illinois (−17 cents), Michigan (−17 cents) and Oklahoma (−16 cents).

- The nation’s top 10 least expensive markets: Texas ($2.88), Mississippi ($3.02), Oklahoma ($3.02), Arkansas ($3.03), Georgia ($3.03), Louisiana ($3.07), Tennessee ($3.10), Missouri ($3.10), Alabama ($3.12) and South Carolina ($3.13).

Oil Market Dynamics

At the close of Friday’s formal trading session, WTI decreased by $1.66 to settle at $76.28. Crude prices dropped last week despite the EIA reporting that total domestic commercial crude stocks declined substantially by 3.7 million bbl. Instead, prices declined because the market is concerned that oil demand could decrease due to growing economic concerns. For this week, persistent concerns that economic growth might stall or reverse course could push prices lower. However, the Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia, collectively known as OPEC+, are meeting on December 4. In October, OPEC+ decided to cut its collective crude oil output by 2 million b/d through 2023. If OPEC+ decides to revise its production reduction agreement to more than 2 million b/d, prices could spike.

Drivers can find current gas prices along their route using the AAA TripTik Travel planner.

About The Crude Life

Award winning interviewer and broadcast journalist Jason Spiess and Content Correspondents engage with the industry’s best thinkers, writers, politicians, business leaders, scientists, entertainers, community leaders, cafe owners and other newsmakers in one-on-one interviews and round table discussions.

The Crude Life has been broadcasting on radio stations since 2012 and posts all updates and interviews on The Crude Life Social Media Network.

Everyday your story is being told by someone. Who is telling your story? Who are you telling your story to?

#thecrudelife promotes a culture of inclusion and respect through interviews, content creation, live events and partnerships that educate, enrich, and empower people to create a positive social environment for all, regardless of age, race, religion, sexual orientation, or physical or intellectual ability.

Sponsors, Music and Other Show Notes

Studio Sponsor: The Industrial Forest

The Industrial Forest is a network of environmentally minded and socially conscious businesses that are using industrial innovations to build a network of sustainable forests across the United States.

Weekly Sponsor: Stephen Heins, The Practical Environmentalist

Historically, Heins has been a writer on subjects ranging from broadband and the US electricity grid, to environmental, energy and regulatory topics.

Heins is also a vocal advocate of the Internet of Everything, free trade, and global issues affecting the third of our planet that still lives in abject poverty.

Heins is troubled by the Carbon Tax, Cap & Trade, Carbon Offsets and Carbon Credits, because he questions their efficacy in solving the climate problem, are too gamable by rent seekers, and are fraught with unreliable accounting.

Heins worries that climate and other environmental reporting in the US and Europe has become too politicized, ignores the essential role carbon-based energy continues to play in the lives of billions, demonizes the promise and practicality of Nuclear Energy and cheerleads for renewable energy sources that cannot solve the real world problems of scarcity and poverty.

Weekly Sponsor: Great American Mining Co

Great American Mining monetizes wasted, stranded and undervalued gas throughout the oil and gas industry by using it as a power generation source for bitcoin mining. We bring the market and our expertise to the molecule. Our solutions make producers more efficient and profitable while helping to reduce flaring and venting throughout the oil and gas value chain.

Join Podcasters from across the world and all walks of life as they unite to bring civil solutions to life and liberty.

Studio Email and Inbox Sponsor: To Be Announced

Featured Music: Alma Cook

For guest, band or show topic requests, email studio@thecrudelife.com

Spread the word. Support the industry. Share the energy.