Kunal Patel, senior business economist, at the Federal Reserve Bank of Dallas joined Jason Spiess to discuss the new Energy Survey release March 21, 2022. As a member of the Research Department’s energy group, Patel analyzes and investigates developments and topics in the oil and gas sector. He is also heavily involved with the production of the Dallas Fed Energy Survey and is an organizer of the annual Dallas Fed–Kansas City Fed energy conference.

Before joining the Dallas Fed in 2017, Patel worked in a variety of energy-related positions at Luminant, McKinsey and Co. and Bank of America Merrill Lynch. Patel received a bachelor of business administration from the Business Honors Program at the University of Texas at Austin and an MBA in finance from the University of Texas at Dallas.

About 200 Firms Surveyed

The Dallas Fed conducts a quarterly survey of about 200 oil and gas firms located or headquartered in the Eleventh District—Texas, southern New Mexico and northern Louisiana—which operate regionally, nationally or internationally.

The information collected is a valuable component of economic analysis and serves as input for Federal Open Market Committee monetary policy deliberations. Survey respondents are asked whether various measures of their firms’ business activities have increased, decreased or remained unchanged relative to the prior quarter and the year-ago quarter. Responses are aggregated into diffusion indexes; positive values indicate expansion while negative values indicate contraction.

Activity in the oil and gas sector accelerated in first quarter 2022, according to oil and gas executives responding to the Dallas Fed Energy Survey. The business activity index—the survey’s broadest measure of conditions facing Eleventh District energy firms—jumped from 42.6 in the fourth quarter to 56.0, reaching its highest reading in the survey’s six-year history.

Oil production increased at a faster pace, according to executives at exploration and production (E&P) firms. The oil production index rose sharply from 19.1 in the fourth quarter to 45.0 in the first quarter. Similarly, the natural gas production index advanced 14 points to 40.0.

Costs increased for a fifth straight quarter. Among oilfield services firms, the index for input costs increased from 69.8 to 77.1—a record high. Only one of the 50 responding oilfield services firms reported lower input costs this quarter. Among E&P firms, the index for finding and development costs advanced from 44.9 in the fourth quarter to 56.0 in the first. Additionally, the index for lease operating expenses also increased, from 42.0 to 58.9. Both indexes reached highs for the survey’s six-year history.

Oilfield services firms reported improvement across all indicators. The equipment utilization index remained elevated but edged down from 51.1 in the fourth quarter to 50.0 in the first. The operating margin index advanced from 11.6 to 21.3. The index of prices received for services jumped from 30.3 to 53.2, a record high.

All labor market indexes in the first quarter reached record highs, pointing to strong growth in employment, hours and wages. The aggregate employment index posted a fifth consecutive positive reading and increased from 11.9 to 28.0. The aggregate employee hours index jumped from 18.0 to 36.0. The aggregate wages and benefits index also rose, from 36.6 to 54.0.

Six-month outlooks improved significantly, with the index climbing from 53.2 last quarter to 76.3, a record high. The outlook uncertainty index also jumped from -1.5 to 31.9, suggesting uncertainty became much more pronounced this quarter.

On average, respondents expect a West Texas Intermediate (WTI) oil price of $93 per barrel by year-end 2022; responses ranged from $50 to $200 per barrel. Survey participants expect Henry Hub natural gas prices of $4.57 per million British thermal units (MMBtu) at year-end. For reference, WTI spot prices averaged $103.07 per barrel during the survey collection period, and Henry Hub spot prices averaged $4.65 per MMBtu.

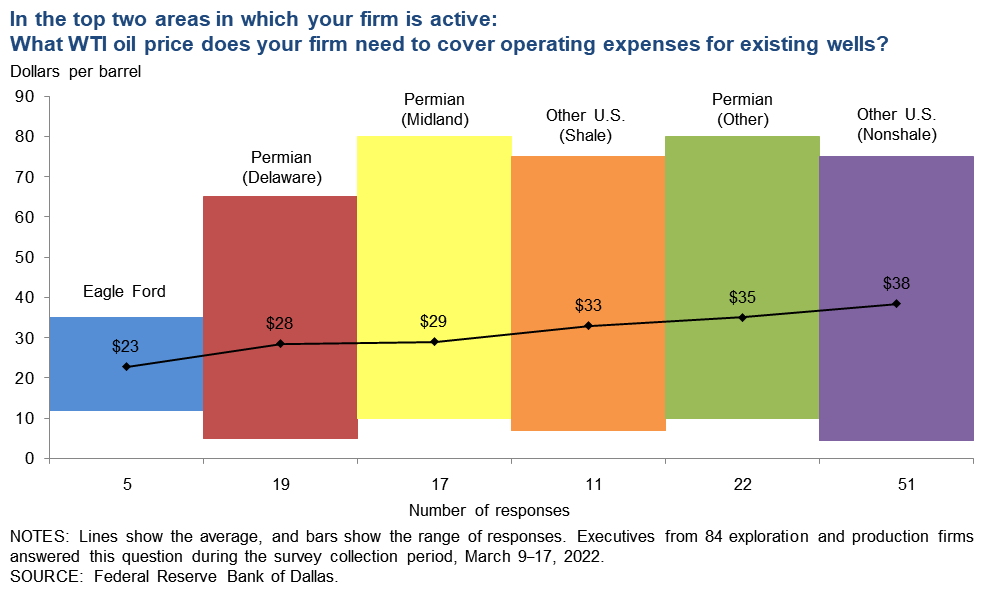

In the top two areas in which your firm is active: What West Texas Intermediate (WTI) oil price does your firm need to cover operating expenses for existing wells?

The average price across the entire sample is approximately $34 per barrel, up from $31 last year. Across regions, the average price necessary to cover operating expenses ranges from $23 to $38 per barrel. All respondents can cover operating expenses for existing wells at current prices.

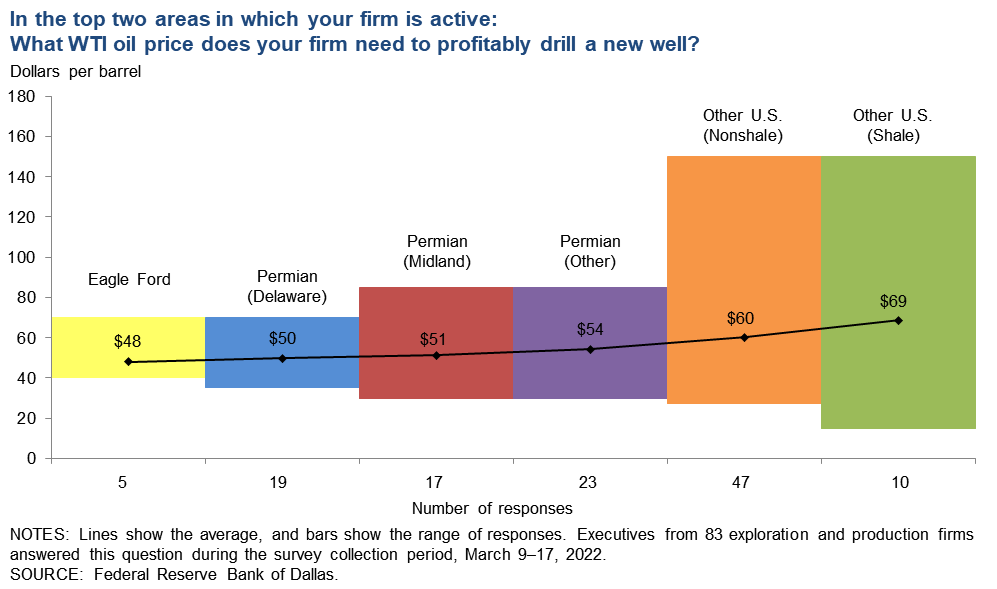

In the top two areas in which your firm is active: What WTI oil price does your firm need to profitably drill a new well?

For the entire sample, firms need $56 per barrel on average to profitably drill, higher than the $52-per-barrel price when this question was asked last year. Across regions, average breakeven prices to profitably drill a new well range from $48 to $69 per barrel. Breakeven prices in the Permian Basin average $52 per barrel, $2 higher than last year. With the jump in oil prices, almost all firms in the survey can profitably drill a new well at current prices (March 17’s WTI spot price was $103 per barrel).

Large firms (with crude oil production of 10,000 barrels per day (b/d) or more as of fourth quarter 2021) need $49 per barrel on average to profitably drill, lower than the $59 for small firms (less than 10,000 b/d).

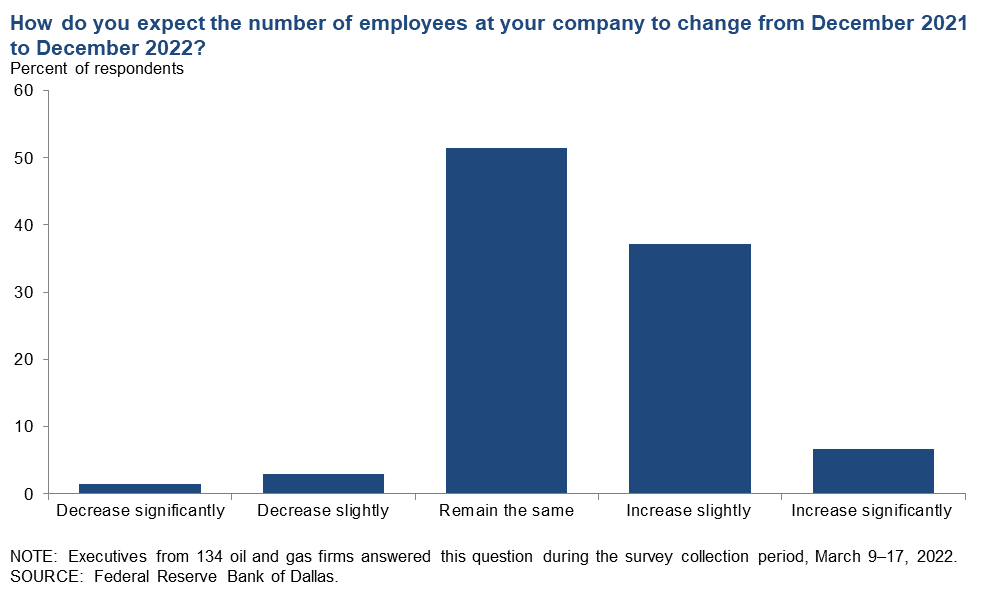

How do you expect the number of employees at your company to change from December 2021 to December 2022?

Slightly more than half of the executives—51 percent—expect their head count to remain unchanged from December 2021 to December 2022. Forty-four percent of executives expect the number of employees to increase, of which 7 percent expect a significant increase and 37 percent expect a slight increase. Only 4 percent expect the number of employees to decrease over the period.

Sixty-six percent of support services firms anticipate increasing the number of employees in 2022 versus 31 percent for E&P firms.

Special Questions Comments

Exploration and Production (E&P) Firms

The industry is facing serious supply issues for the materials needed to grow production. The supply-chain issues and shortage of materials are unprecedented. We are also facing serious workforce issues because a meaningful portion of the labor force left the industry during the downturn and due to the vilification of the oil and gas industry. The message from the White House, Capitol Hill and Wall Street has been that oil and gas is a dying industry and one that needs to be abandoned. Even if funding were available and supply-chain issues were resolved, it is unlikely that the labor shortage will be resolved any time soon and simply by paying higher wages.

Traditional lending and capital markets access for exploration and production companies are down across the board over the last several years and historically low compared to the commodity environment we are in today. Private-equity capital for oil and gas is down 70 to 80 percent over the last several years. Is this a response to low-carbon and/or ESG-related interest by banks and investors, or is it in part to the market adjusting to an administration that made it clear from day one they do not support new oil and gas development and have put appointments in key agencies in place that support this view? It is probably both, but that still tells smaller public and private independents that they cannot rely on external capital, and that they should restrain their budgets accordingly, at a time when supply growth would certainly help. Exploration and production companies need to keep engaging on why responsible oil and gas development and growth in energy-transition technology is the right combination to give consumers the best outcome, so there is more bipartisan support for sound energy policy.

The U.S. needs to increase production by about two million barrels per day to balance global supply and demand in 2023. It is looking unlikely that this will happen, which will result in sustained higher energy prices until the American consumer is pushed into a recession. The industry leadership continues to be lackluster, swinging from demands for proration in 2020 to demands for the administration to call them to increase production in 2022. The compelling future of the upstream business needs to be to grow production to meet worldwide demand during the energy transition while maintaining returns on capital employed and the world’s highest environmental, social and governance (ESG) standards. Unfortunately, no leaders have this thesis.

My business has changed drastically due to the hostile political situation in Colorado toward the oil and gas industry. In the first quarter of 2021, I divested all properties in the state of Colorado due to the unbelievably hostile and increasingly aggressive regulatory environment driven by anti-fossil-fuel ideology. This has created an unstable and unpredictable place to do business in Colorado. The administrative state, driven and encouraged by the governor and legislature, has been given carte blanche to become judge, jury and executioner of the oil and gas industry.

The U.S. needs to fast track infrastructure, such as the Keystone pipeline, Mountain Valley pipeline, Constitution pipeline and liquefied natural gas export facilities and eliminate the Jones Act. Regulation is significantly hurting and hampering U.S. energy production. Safety and environmental standards in the U.S. are better than in major exploration and production areas internationally. The U.S. needs to prioritize U.S. energy and the U.S. supply chain.

Investors dumped huge funds into shale drilling only to discover that when oil prices dropped, very little value existed at the end of the day. Investors have demanded restraint and capital discipline of their client companies. Government posturing and increased regulations are severely hampering the entire industry. Permitting roadblocks and politically emplaced barriers should be removed as this is dampening the willingness of anyone trying to bring new investments to the industry, regardless of that investment being for a private or public entity.

Publicly traded companies need to see the West Texas Intermediate crude oil strip-price backwardation muted before they will consider growing again.

The probability distribution of prices is now more weighted toward lower prices for several reasons. First, at some point, the Russia–Ukraine war may cause demand destruction. Second, renewed city shutdowns in China indicate that COVID-19 could cause another recession in conjunction with the impacts of the Russia–Ukraine war. Third, a return to “normalcy” without precautionary buying due to the Russia–Ukraine war will remove some of the added demand that has fueled higher oil prices over the past several months.

U.S. government actions and intentions are not helping U.S. producers to increase domestic oil and gas supplies appreciably.

Increasingly onerous government regulations and/or policies regarding upstream, midstream and downstream (refining) operations have made it difficult for companies in these sectors to make money. Geopolitical risk and concern about higher taxation have also impeded activity.

Supply and demand are now subjected to significant domestic and international political and market conflicts and disruptions, resulting in a significant challenge to develop credible strategic assessments and planning. This has resulted in a preference for risk avoidance with respect to strategic capital commitments.

Oil and Gas Support Services Firms

We have the rigs but can’t find employees. However, oil companies have to understand that oilfield services and, in particular, onshore land drilling contractors have to be paid a livable rate to justify the enormous capital cost of running, upgrading and crewing a modern onshore drilling rig.

The lack of people to work, and the delivery and cost of pipe, frac sand, cement, etc., are all concerns for our business. It will take quite of bit of time for growth to happen. There is also investor pressure.

I feel that the primary reason that publicly traded oil producers are restraining growth despite high oil prices is a two-headed monster, with capital discipline and governmental regulations due to the green progressives in the administration’s ear.

The answer to the primary reason that publicly traded oil producers are restraining growth despite high oil prices is a combination of investor pressure, ESG issues, government regulation and lack of growth capital. It was difficult to say any of those were the primary reason. Spending will increase with improved cash flow, but I don’t see companies raising capital and going into debt to invest in production growth.

Discipline continues to dominate the industry. Shareholders and lenders continue to demand a return on capital, and until it becomes unavoidably obvious that high energy prices will sustain, there will be no exploration spending.

In this upcycle, investors have made it clear they wanted to see discipline from all players. So far, E&Ps for the most are exhibiting capital discipline. A significant part of E&P capital spending growth this year (2022 versus 2021) will be consumed by cost inflation as the cost for all inputs continues to increase against a backdrop of supply-chain challenges and limited incremental equipment being reactivated (due to fiscal constraints and manpower challenges within oilfield services and related suppliers).

The administration is still restricting our control on how we operate our wells. We are governed by the Texas Railroad Commission, which is enough authority over us. The administration has no clue about the oil and gas industry.

Energy Roundtable on Expanding Access to Capital with North Dakota Petroleum Council, Minneapolis Fed

U.S. Senator Kevin Cramer (R-ND), member of the Senate Banking Committee and Environment and Public Works Committee, participated in a roundtable discussion hosted by the North Dakota Petroleum Council (NDPC) President Ron Ness on expanding access to capital to ensure American energy security. The roundtable also featured Federal Reserve Bank of Minneapolis President and CEO Neel Kashkari.

“My mission today was simple: foster a discussion on what oil and gas producers and hardworking men and women in the fossil fuel industry need to get North Dakota back to 1.5 million barrels of oil per day? What will it take? We had a great discussion full of sage advice and counsel from Minneapolis Fed President and CEO Kashkari and North Dakota Petroleum Council members today,” said Senator Cramer. “We produce oil and gas in the cleanest and best possible way in the Bakken. The world is watching. What can America do to meet energy demands in a responsible way?”

“It was great to have Senator Cramer and Neel Kashkari speak to our members. World demand for our product is growing, but international investment is down, which presents us with a great opportunity to grow our production here in the U.S. We need to inspire our young people to join the industry and create the workforce necessary to meet demand. We must also inspire investment that we need to grow production, which will help us lead the world in production and ensure security and prosperity here at home,” said NDPC President Ness.

During the roundtable they discussed global market and oil prices, the ongoing labor shortage, permitting challenges, inflation, the need for more midstream infrastructure, and debunked the Biden Administration’s 9000 permits falsehoods.

Senator Cramer also highlighted recent meetings with foreign energy ministers including European Commissioner for Energy Kadri Simson and forthcoming climate disclosure regulations from the Biden Administration’s Securities and Exchange Commission.

If anyone would like to schedule an interview, meeting or news tip email studio@thecrudelife.com

Industrial Integrity and Energy Ethics are the new entry level expectations in oil and gas, and The Crude Life continues to create original Local, Boots-On-The-Ground Journalism while showcasing other environmentally conscious companies.

Communication is vital in today’s energy extraction and empowerment.

About The Crude Life

The Crude Life produces original content that focuses on industry, the people, energy innovations, community building and it’s proactive culture. Our custom content is non-polarizing, trusted and often news making.

The Crude Life promotes a culture of inclusion and respect through interviews, content creation, live events and partnerships that educate, enrich, and empower people to create a positive social environment for all, regardless of age, race, religion, sexual orientation, or physical or intellectual ability.

Part of our mission is to enable people, companies and communities to affect change, demonstrate their transformative actions and drive energy awareness through storytelling and access to resources.

Sponsors, Music and Other Show Notes

Studio Sponsor: The Industrial Forest

The Industrial Forest is a network of environmentally minded and socially conscious businesses that are using industrial innovations to build a network of sustainable forests across the United States.

Weekly Sponsor: KBL Complete Services

Strikingly dynamic, incomparably strong and absolutely reliable, KBL Complete Services excels at all of your pipeline needs. From AGM Surveys, ILI tool tracking, Digsite Locating, and Equipment Decontamination, to Project Management, KBL Complete Services are ready to make your project a success.

Weekly Sponsor: Great American Mining Co

Great American Mining monetizes wasted, stranded and undervalued gas throughout the oil and gas industry by using it as a power generation source for bitcoin mining. We bring the market and our expertise to the molecule. Our solutions make producers more efficient and profitable while helping to reduce flaring and venting throughout the oil and gas value chain.

Join Podcasters from across the world and all walks of life as they unite to bring civil solutions to life and liberty.

Studio Email and Inbox Sponsor: To Be Announced

Featured Music: Alma Cook

For guest, band or show topic requests, email studio@thecrudelife.com

Spread the word. Support the industry. Share the energy.