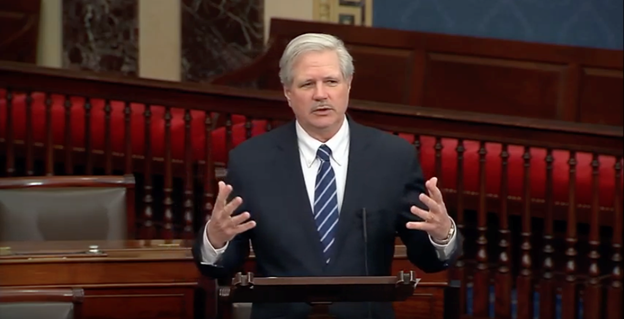

At a hearing of the Senate Energy and Natural Resources Committee this week, Senator John Hoeven advocated for enhancements to the 45Q tax credit to further advance carbon capture, utilization and storage (CCUS) technologies. The senator, along with Assistant Secretary of Fossil Energy Steven Winberg, Carbon Utilization Research Center Executive Director Shannon Angielski and Dr. Julio Friedman with the Columbia University Center on Global Energy Policy, highlighted the impacts of the coronavirus disease 2019 (COVID-19) pandemic and federal permitting delays on the development of CCUS projects, stressing the need to:

-

Provide a direct payment option for claiming the 45Q tax credit.

- As many investment partners will have significantly reduced tax liability due to economic impacts of COVID-19, a direct payment, or grant in lieu of credit option for 45Q, would make the financing of CCUS projects more feasible, particularly for tax-exempt rural electric cooperatives, as the economy recovers from the public health emergency.

-

Extend the time available for companies to claim the 45Q tax credit.

- Under current law, projects must commence construction by the end of 2023 and can claim the credit for 12 years, whereas other energy technologies, including solar and wind, have benefitted from decades of incentives. Extending these timeframes would help more CCUS projects reach economic viability and enable these technologies to be more broadly implemented.

“CCUS technologies support the continued use of reliable baseload power sources, like lignite coal, while also reducing emissions and promoting better environmental stewardship,” said Hoeven. “That’s an opportunity to grow our nation’s role as a leader in clean coal technology, especially as other countries continue to construct new coal-fired power plants. By enhancing the 45Q tax credit, including establishing a longer timeframe for claiming the credit and providing a direct payment option, we can help ensure efforts like Project Tundra continue advancing through challenges like the COVID-19 pandemic and are able to reach commercial viability.”

This discussion builds on Hoeven’s efforts with the White House, Department of the Treasury and the Department of Energy to get the 45Q tax credit implemented in a manner that will make CCUS projects more commercially-viable:

- Hoeven previously worked to pass legislation to reform and expand the 45Q tax credit and advanced the 45Q tax credit’s implementation, including raising the issue with President Trump and White House Chief of Staff Mark Meadows.

- Following Hoeven’s efforts, the U.S. Department of the Treasury issued rules to implement the credit, including two provisions the senator helped secure to benefit coal facilities, enhanced oil and gas recovery (EOR) operations and project developers in North Dakota:

- An expanded definition of Carbon Capture Equipment (CCE), providing broader eligibility for the tax credit, including for the state’s coal-fired power plants.

- A provision, similar to Hoeven’s CO2 Regulatory Certainty Act, to ensure the tax credit works both for long-term storage and enhanced oil recovery.

The Crude Life Podcast can be heard every Monday through Thursday with a Week in Review on Friday.

Spread the word. Support the industry. Share the energy.