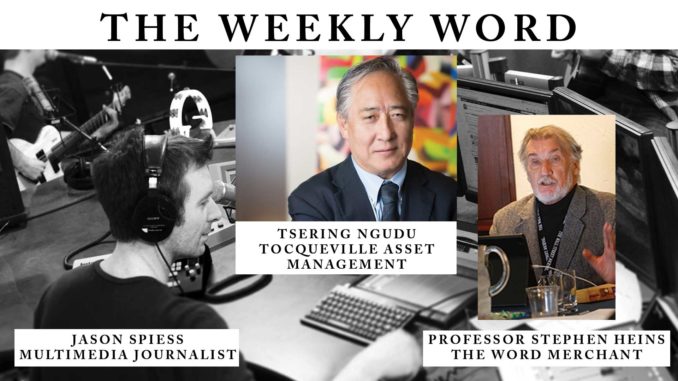

The Weekly Word is a weekly high level discussion about energy, quality of life, globalism and the environment. This week Professor Stephen Heins and Jason Spiess are joined by Tsering Ngudu is a Senior Equity Analyst at Tocqueville Asset Management L.P.. Summary written by Stephen Heins, The Word Merchant.

Jason Spiess and “the professor” Stephen Heins host Tsering Ngudu, Senior Analyst of Tocqueville Asset Management of NYC on the Weekly Word.

In introducing Mr. Ngudu, Heins talked about Tsering’s extensive oil and energy background on Wall Street. Also, Heins remarked that in a previous discussion, Tsering had mentioned that he really didn’t know much about the Bakken. To many people on Wall Street, the beginnings of the Shale Revolution (begun in the Bakken) would not offset the ever shrinking of American oil production over the last decades. In response, Spiess mentioned that, in the last decade, the Bakken had grown from 30,000 barrels a day to 1 million barrels a day.

From his perch, Ngudu was not a “believer” in the first tranche of fracking, because value investors as a whole stood on the sidelines. Therefore, he remained in the dark about Bakken. In fact, Ngudu asked Spiess several questions about the North Dakota energy scene and Jason’s close Bakken involvement during the last 7 or 8 years.

“One of the advantages of the Bakken, it has extensive core samples dating back to the 1950’s,” Spiess also mentioned that since the oil correction, Bakken operators had helped reduced their operating costs by using new technology to harvest a combination of new wells and “refracs” to sell into the lower oil prices. The “drilled but uncompleted” (DUC) wells are likely to be great insurance for the future cost of fracking.

Ngudu mentioned that the Bakken (and even the trend-setting new Davis Refinery) are considered less interesting to a Wall Street than the Permian where many of the shale industry have doubled down by buying Permian and selling Bakken, but Heins interjected that the Bakken remains an important economic and technology development story. North Dakota is a real American success story, noted Heins, and is another example of the power of U.S. innovation, which has “the machinery for change.”

Spiess recalled a speech from Steven Moore, Op Ed contributor to the Wall Street Journal, where Moore said that Texas and North Dakota were the only states to money in the last decade and that the oil/shale industry were the only sector to create jobs in the same period. Without current socio-economic statics in hand, all three agreed that their learned and anecdotal information supported both of Moore’s observations.

As for the shale industry, Ngudu observed that the entire supply, distribution, and consumption chain of shale had given the U.S. economy an important cost, geopolitical, job creation, and emission reduction advantage over the rest of the world. “The U.S. has led the world in emission reductions over the last decade,” said Ngudu.

Obviously, Ngudu, Spiess and Heins enjoyed talking about this great economic renaissance of the oil and industries in America.

Ngudu joined Tocqueville in 2002 and is responsible for contributing ideas to the Multi Cap Equity and International Multi Cap Equity strategies, with a research focus on the energy and financial services industries. Prior to joining Tocqueville, Mr. Ngudu worked as a Portfolio Manager and Analyst at Lepercq de Neuflize from 1985-2001. From 1984-1985, he was an Analyst at Cates Consulting.

Mr. Ngudu earned a B.A. from Dartmouth College and an M.B.A. from Pace University.